Table of Contents

Where to Invest Your Money in South Africa

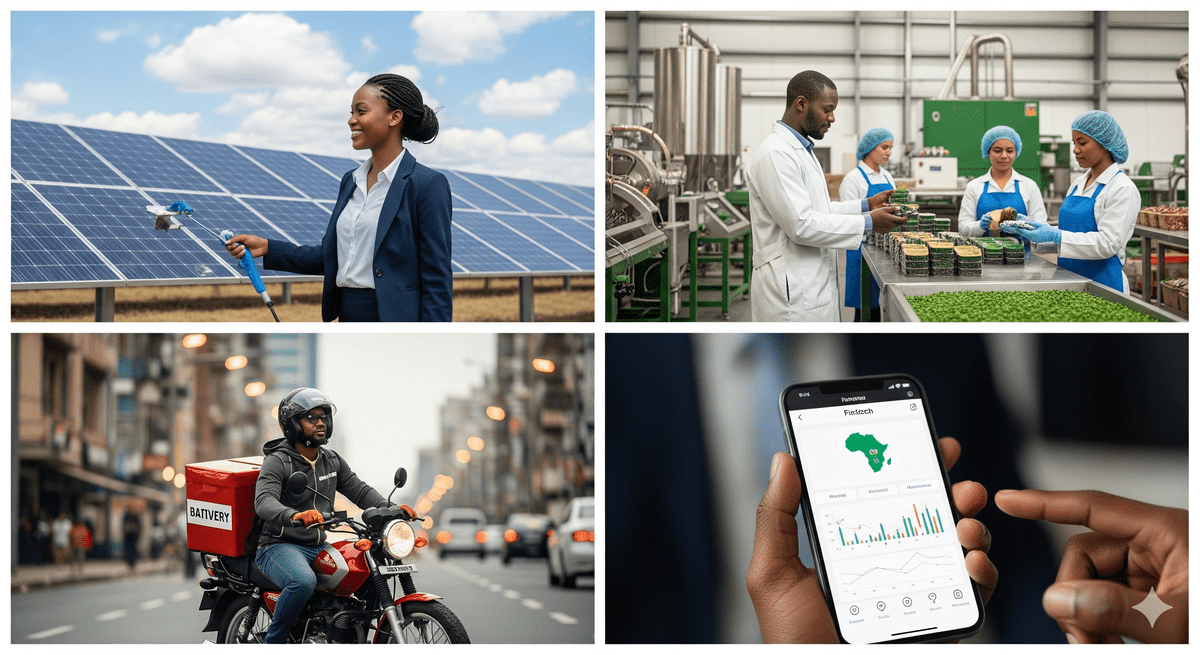

Whether you’re a seasoned investor or just starting, knowing where to invest your money in South Africa can help you build a resilient and profitable portfolio. South Africa is a land of opportunity, offering diverse investment options across various sectors. In this guide, we’ll explore the top investment opportunities in South Africa and explain why expanding your investments to Namibia with the help of Investing in Namibia can further enhance your returns.

Why Invest in South Africa?

South Africa is one of the most developed economies in Africa, offering a stable financial system, a growing middle class, and a wealth of natural resources. From real estate to renewable energy, the country provides numerous opportunities for investors looking to diversify their portfolios. However, navigating the investment landscape can be challenging without the right guidance.

Top Investment Opportunities in South Africa (Where to Invest Your Money in South Africa)

1. Real Estate

South Africa’s real estate market is booming, driven by urbanization and demand for modern living spaces. Key cities like Cape Town, Johannesburg, Pretoria, and Durban offer strong rental yields and capital appreciation potential. Cape Town, in particular, is experiencing a tech-driven housing boom, making it a hotspot for property investors.

2. Infrastructure Development

Infrastructure investments are on the rise, with the government and private sector focusing on projects like roads, railways, and renewable energy. These projects not only support economic growth but also offer long-term returns for investors.

3. Technology and Innovation

South Africa’s tech industry is thriving, with Cape Town emerging as a hub for startups. Investments in AI, cybersecurity, and data analysis are particularly promising, offering high growth potential.

4. Energy Sector

The energy sector is a lucrative investment opportunity, especially in renewable energy. Solar, wind, and other green energy projects are gaining traction as South Africa works to bridge its energy gap. Additionally, the mining of critical minerals like copper, cobalt, and platinum is essential for the global energy transition.

5. Financial Markets

Investing in the stock market through dividend-paying stocks and ETFs can provide steady income and capital appreciation. ETFs like the WisdomTree US Quality Dividend Growth Fund and Global X S&P 500 Quality Dividend ETF are popular choices for investors.

6. Agriculture

Agricultural investments, particularly in fish farming and cannabis farming, are gaining popularity. These sectors offer long-term returns and act as a hedge against market volatility. Crowdfunded agricultural projects are also becoming a viable option for investors.

7. Tax-Free Investments

Tax-free investments in South Africa allow for tax-free growth on returns, making them an attractive option for long-term savings. These can include unit trusts, fixed deposits, and certain endowment policies.

8. Gold (Where to Invest Your Money in South Africa)

Gold remains a reliable store of value and a hedge against inflation. Investing in physical gold or gold mining companies through ETFs like the SPDR Gold MiniShares Trust and iShares Gold Trust Micro can provide stability to your portfolio.

9. Short-term Bonds

Short-term government bonds are a low-risk investment option that can provide steady returns. They are particularly attractive if you anticipate interest rate cuts, which could boost bond prices.

10. Alternative Investments

Alternative investments like rare whiskey and cannabis farming are gaining traction due to their high return potential. However, these investments are complex and often operate in unregulated markets, making them high-risk but potentially rewarding.

Stop Waiting on Stagnant Markets.

Strike Gold in Africa.

While Western economies face saturation and sluggish growth, African markets are booming. Namibia offers a highly politically stable, safe, business-friendly gateway to the African continent.

Join global investors scaling across 54 African jurisdictions with our business registration services.

Why Consider Expanding Your Investments to Namibia?

While South Africa offers excellent investment opportunities, diversifying your portfolio across borders can further enhance your returns. Namibia is one of Africa’s most promising investment destinations, offering:

- A stable political and economic environment.

- Investor-friendly policies under the Foreign Investment Act.

- Thriving industries in mining, agriculture, renewable energy, and tourism.

- Strategic infrastructure projects like the Walvis Bay commercial port, which positions Namibia as a trade hub for landlocked countries.

At Investing in Namibia, we specialize in helping foreign investors establish and grow their businesses in Namibia. From business registration to legal compliance and operational management, our team provides tailored solutions to streamline your investment journey.

Final Thoughts on Where to Invest Your Money in South Africa

South Africa offers a wealth of investment opportunities across various sectors, from real estate and technology to renewable energy and agriculture. By diversifying your portfolio and exploring cross-border investments in countries like Namibia, you can maximize your returns and build a resilient investment strategy.

Ready to take the next step? Visit Investing in Namibia to learn how we can help you expand your investments and achieve your financial goals.

- How to Register a Business in Namibia

- Business Registration Services in Namibia

- Business and Intellectual Property Authority (BIPA)

By following this guide and leveraging professional services, you’ll be well on your way to building a diversified and profitable investment portfolio in South Africa and beyond. Let’s make your investment goals a reality!

How Do I Invest in Bitcoin in Nigeria?

How to Invest in Bonds in Nigeria

Leave a Reply