Table of Contents

Day Trading Rules Under 25k: Your Essential Guide

Navigating the financial markets as a day trader with less than $25,000 in your brokerage account can seem daunting. The day trading rules under 25k established by the SEC are crucial for protecting individual investors from excessive risks. Understanding these rules allows traders to maximize profits while minimizing losses, providing a solid foundation for successful trading.

What Are the Day Trading Rules Under 25k?

Day trading rules under 25k primarily revolve around the Pattern Day Trader (PDT) rule, which dictates that traders with less than $25,000 in their accounts can only execute three day trades in a rolling five-business-day period. This limitation is designed to prevent excessive trading and encourage more thoughtful, strategic approaches.

What Is Pattern Day Trading?

Pattern Day Trading refers to buying and selling the same security within a single trading day, specifically four or more times within five business days. Once you hit this threshold, you’re classified as a pattern day trader and must maintain an account balance of at least $25,000.

How to Navigate Day Trading Rules Under 25k

While the PDT rule can feel restrictive, there are several strategies to stay active in the markets without breaching this limit.

Open Multiple Brokerage Accounts

One effective strategy is to distribute your trading activity across multiple brokerage accounts. By doing this, you can potentially make more trades than the PDT rule typically allows for a single account. However, this approach requires meticulous management to ensure compliance with all brokerages’ regulations.

Switch to a Cash Account

Consider switching from a margin account to a cash account. Cash accounts are not subject to the PDT rule, allowing for unlimited trades as long as each trade is fully funded. Keep in mind that you’ll need to wait for trades to settle before using those funds again.

Mind Your Time Frame

Extending your trading time frame can also help. Instead of focusing solely on day trading, consider swing trading, where you hold positions for several days. This approach allows you to bypass day trading restrictions altogether.

Benefits of Options Trading for Accounts Under 25k

Options trading can be especially beneficial for accounts under $25,000. By using options, you can control larger positions with a smaller amount of cash, providing the leverage needed to maximize your trading potential without breaching the PDT rule.

Managing Risk Through Position Sizing

Proper risk management is crucial for success in day trading, particularly for those with limited funds. Position sizing—deciding how much of your capital to allocate to a particular trade—can help mitigate losses while maximizing gains.

Alternatives to Traditional Day Trading

If you’re restricted by the $25,000 rule, consider exploring alternative markets such as cryptocurrency and forex trading. These markets often have different regulatory requirements, allowing for more flexibility in trading strategies.

Day Trading Tips Under 25k

- Learn to Trade Options: Options can offer you the leverage needed to trade effectively within the constraints of your account size.

- Plan Your Trades: Planning your trades in advance helps avoid impulsive decisions, which is critical when you’re working with a limited budget.

- Trade Less Than the Maximum Requirement: While you can make up to three day trades, consider trading fewer than that to allow yourself some room for maneuvering.

- Stick to High Probability Setups: Focus on high-probability trading setups by conducting thorough research and analysis.

Why Do Pattern Day Trading Rules Exist?

The PDT rules were implemented to protect inexperienced traders from taking on excessive risks. They ensure that traders have sufficient funds to engage in frequent trading, promoting more sustainable trading practices.

The Role of 1000pip Builder Service

For those navigating these rules, the 1000pip Builder Service offers a valuable resource. Designed for traders without years of experience, the service provides expert analysis and real-time trading signals via email, SMS, and Telegram. With guidance from seasoned traders, you can follow actionable trades, ensuring you stay within regulatory limits while capitalizing on market opportunities.

Stop Waiting on Stagnant Markets.

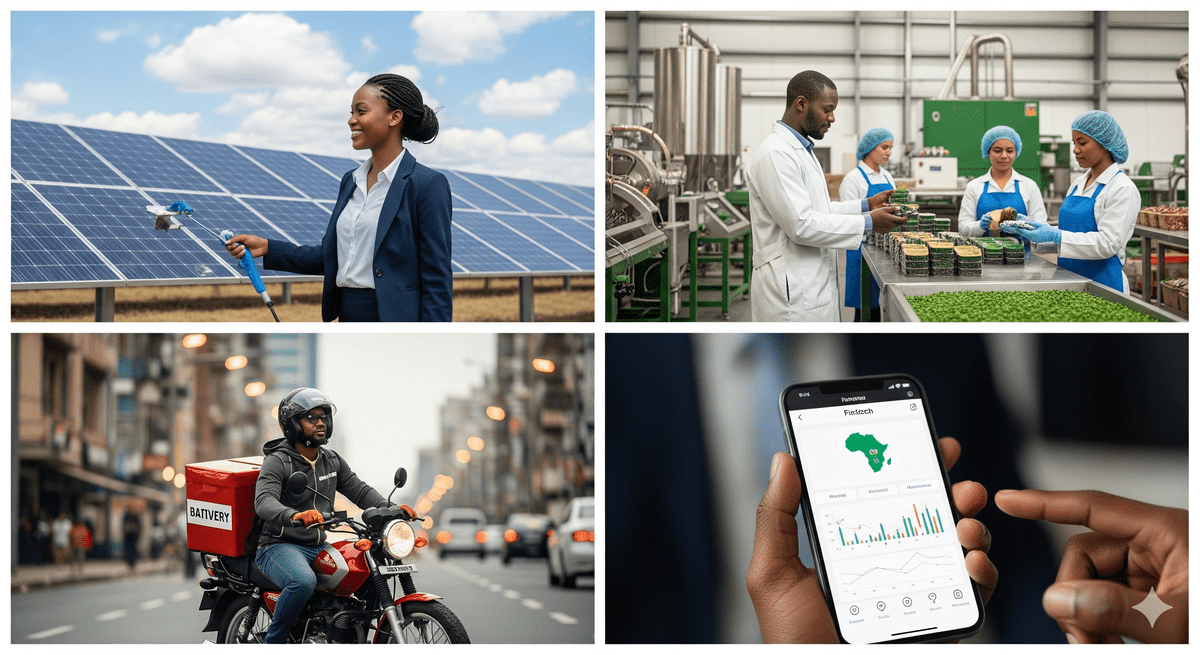

Strike Gold in Africa.

While Western economies face saturation and sluggish growth, African markets are booming. Namibia offers a highly politically stable, safe, business-friendly gateway to the African continent.

Join global investors scaling across 54 African jurisdictions with our business registration services.

Join the 1000pip Builder Service today and get on the fast track to trading success: Sign Up Here.

Final Thoughts on Day Trading Rules Under 25k

Understanding the day trading rules under 25k is essential for anyone looking to succeed in day trading. By employing strategic approaches and utilizing resources like the 1000pip Builder Service, you can effectively navigate these regulations and enhance your trading experience. Stay informed, plan your trades, and engage with fellow traders to make the most of your day trading journey!

Day Trading Apps for Beginners: Unlocking Your Trading Potential

Candlestick Patterns for Day Trading: Master the Markets

Best Trading Platform for Day Traders

Leave a Reply