Table of Contents

FNB Namibia LifeStart Student Loan (study loan FNB): Financing Your Tertiary Education

Have you heard about the FNB Namibia LifeStart Student Loan? As a student pursuing higher education, the cost of tuition, accommodation, textbooks, and other living expenses can be overwhelming. That’s where FNB Namibia LifeStart Student Loan (study loan FNB) comes in. The FNB student loans are designed to provide financial assistance to students studying towards internationally recognized degrees, post-graduate degrees, or diplomas at recognized tertiary institutions.

FNB Student Loan: Your Path to Higher Education Finance

Are you ready to pursue higher education but concerned about financing your studies? The FNB Student Loan might be the solution you’ve been searching for. In this section, we will walk you through the FNB Student Loan application process, addressing common questions and concerns, and providing you with valuable insights to make your academic dreams a reality.

Step 1: Determine Your Eligibility – FNB student loans

Before diving into the details of the FNB Student Loan, it’s essential to ensure you meet the eligibility criteria. Here’s a quick overview:

FNB Student Loan Eligibility Criteria

- You must be a citizen.

- Enrolled or registered at a recognized tertiary institution.

- Able to provide proof of income or financial support.

The FNB Student Loan aims to make higher education accessible, so these eligibility criteria are designed to accommodate a wide range of students.

Step 2: Gather Required Documents – FNB student loans

To streamline your student loan application, make sure you have all the necessary documents ready. Having these documents in hand will expedite the process. Here’s what you’ll need:

FNB Student Loan Required Documents

For FNB banked customers:

- A copy of your ID or Smart Card ID.

- Proof of enrolment from your tertiary institution or proof of registration.

For non-FNB banked customers:

- A copy of your ID or Smart Card ID.

- Proof of enrolment from your tertiary institution or proof of registration.

- Proof of residence not older than three months.

- Proof of income:

- Your latest three months’ bank stamped statements reflecting three months’ salary deposits or your latest three months’ payslips.

- If you are self-employed, provide your latest six months’ bank stamped statements and Personal Tax Assessment.

Having these documents ready will ensure a smooth and efficient application process.

Step 3: Initiating the Application

Now that you’ve assessed your eligibility and gathered the required documents, it’s time to kickstart your FNB Student Loan application. Here are some key points to keep in mind:

Application Processing Time – FNB student loans

- A Student Loan application can be processed within 24 hours, depending on the timely submission of supporting documents.

Banked and Non-Banked Customers

- FNB accommodates both banked and non-banked customers, ensuring that a wide range of students can access financial support for their education.

Step 4: Understanding Loan Usage

Understanding how you can utilize your FNB Student Loan is crucial. Here’s a breakdown of what the loan can be used for:

FNB Student Loan Loan Usage

- Tuition fees: Cover the cost of your academic program.

- Textbooks and study materials: Ensure you have the necessary resources for your courses.

- Student accommodation: Secure comfortable living arrangements during your studies.

- Equipment: Invest in devices or tools necessary for your academic success.

The flexibility in loan usage allows you to tailor the funds to your specific educational needs.

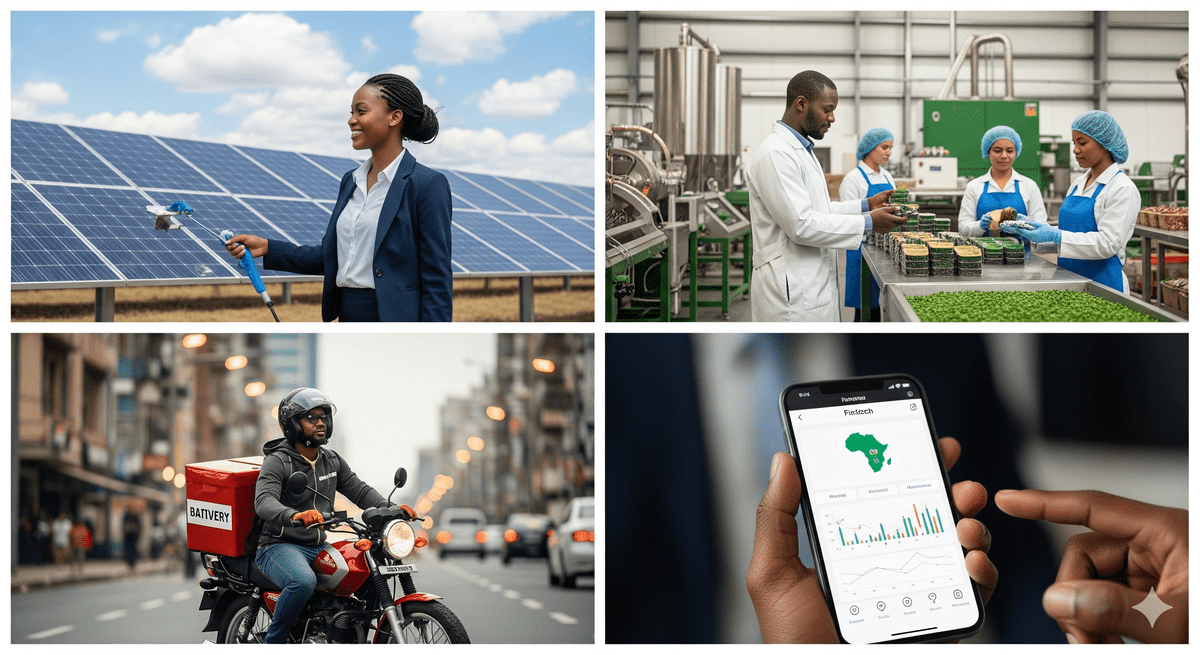

Stop Waiting on Stagnant Markets.

Strike Gold in Africa.

While Western economies face saturation and sluggish growth, African markets are booming. Namibia offers a highly politically stable, safe, business-friendly gateway to the African continent.

Join global investors scaling across 54 African jurisdictions with our business registration services.

Step 5: Dealing with Repayment

It’s essential to be aware of the repayment terms associated with your FNB Student Loan. Here’s what you need to know:

FNB Student Loan Repayment Start Date

- Repayment begins the month following the disbursement of the loan. While you are still studying, you will only be required to pay the interest, fees, and charges.

FNB Student Loan Early Settlement

- Good news! You have the option to settle the loan earlier than the agreed term with no penalties.

Changes in Monthly Instalments

- Your monthly instalment may increase if:

- The repayment of the loan shifts from interest-only to interest plus capital.

- FNB does not receive proof of studies for each academic year before the end of May while you are still studying. In this case, the interest rate will be increased to prime + 10% as per the terms and conditions of the contract.

Understanding these repayment details will help you manage your finances effectively during and after your studies.

Step 6: Additional Loan Information

Let’s address a few more common questions and important details about the FNB Student Loan:

Minimum Academic Duration

- There is no minimum academic duration for the FNB Student Loan. If your academic course duration is less than 12 months, ensure you capture it as 12 months during the application.

Unlisted Institutions

- If your institution is not listed in the application process, continue with the loan application and select “Other Unlisted Institution.” Always double-check that you capture the correct institution details to ensure a smooth application outcome.

FNB Student Loan Interest Rate

- The interest rate for the FNB Student Loan is linked to Prime and varies depending on your credit risk profile. This means that the rate can differ from one customer to another, making it essential to understand your specific terms.

Step 7: Post-Completion Repayments

After you complete your studies and the six months’ grace period has elapsed, your repayments will transition from interest-only to interest plus capital. Be prepared for this transition to manage your finances effectively.

With these comprehensive insights into the FNB Student Loan, you can confidently embark on your higher education journey, knowing that financial support is within your reach. Applying for a student loan is a significant step toward achieving your academic goals, and FNB is here to support your aspirations.

Remember, education is an investment in your future, and the FNB Student Loan is your partner on this educational adventure. Don’t hesitate to take the first step towards a brighter future today!

Why You Need This FNB Namibia LifeStart Student Loan

The FNB Namibia LifeStart Student Loan (study loan FNB) provides you with financial support throughout your studies, covering the cost of tuition and living expenses. During your course of study, your parent, legal guardian, or sponsor only pays interest if they bank with FNB Namibia. After graduation, the capital is repaid over 60 months.

What You Need to Apply FNB LifeStart Student Loan (study loan FNB)

To qualify for this loan, you must be a registered student pursuing an internationally recognized degree or diploma. There is no age limit for student loans (study loan FNB), and both full-time and part-time students can apply. To apply, you will need to provide the following:

- Proof of acceptance by the tertiary institution where you will be studying

- Parents/legal guardian/sponsor who will apply for the loan (an adult who undertakes to repay the debt)

- Parent/legal guardian/sponsor who will take out mortality risk cover

Borrowing Amounts

The amount you can borrow depends on the year of study. Interest rates vary depending on the year of study, and to qualify for a reduced interest rate, the student needs to have an account with FNB Namibia, such as the LifeStart Account. The following are the borrowing amounts and interest rates:

- Year 1: Prime

- Year 2: Prime less 1%

- Year 3: Prime less 2%

- Year 4: Prime less 2%

- Year 5: Prime less 2%

- Year 6: Prime less 2%

Getting The FNB LifeStart Student Loan (study loan FNB) Made Easy

FNB Namibia LifeStart Student Loan (study loan FNB) is available to full-time and part-time students registered at recognized institutions of higher learning. To qualify, your parent, legal guardian, or sponsor must have a clear credit record and be able to afford to repay the loan. The loan application process is easy and can be done in the following ways:

- Start the application process online

- Visit any FNB Namibia branch

- Contact FNB Namibia customer care for assistance

FNB Namibia LifeStart Student Loan (study loan FNB) is a viable solution to finance your education and achieve your academic goals. With competitive interest rates, flexible repayment terms, and an easy application process, this loan is tailored to support your academic journey. Start your application today and take a step towards achieving your academic dreams.

Stop Waiting on Stagnant Markets.

Strike Gold in Africa.

While Western economies face saturation and sluggish growth, African markets are booming. Namibia offers a highly politically stable, safe, business-friendly gateway to the African continent.

Join global investors scaling across 54 African jurisdictions with our business registration services.

Bank Anytime, Anywhere with FNB Mobile App: Features and Benefits

Frequently Asked Questions about FNB Namibia LifeStart Student Loan (study loan FNB)

- Who is eligible to apply for the FNB Namibia LifeStart Student Loan (study loan FNB)?

- All registered students studying towards internationally recognized degrees or post-graduate degrees or diplomas can apply for the loan. There is no age restriction for student loans and both full-time and part-time students can apply.

- What is the purpose of the FNB Namibia LifeStart Student Loan (study loan FNB)?

- The loan serves to finance the cost of studies at a recognized tertiary institution.

- Who can apply for the loan on behalf of the student?

- Parents, legal guardians, or sponsors who undertake to repay the debt can apply for the loan on behalf of the student.

- What documents are required to apply for the LifeStart Student Loan (study loan FNB)?

- Applicants need to provide proof of acceptance by the tertiary institution where they are going to study, and the parent/legal guardian/sponsor needs to take out mortality risk cover.

- What is the interest rate on the LifeStart Student Loan (study loan FNB)?

- The interest rate varies depending on the year of study, with the first year being prime and subsequent years being prime less 1% to prime less 2%. To qualify for the reduced rate, the student needs to have an account with FNB, such as the LifeStart Account.

- How is the loan repaid?

- During the course of the studies, the parent, guardian or sponsor only pay interest if the main account holder banks with FNB Namibia. After the student has graduated, the capital is repaid over a period of 60 months.

- Can the loan cover other expenses besides tuition?

- Yes, the loan can cover other expenses such as textbooks, accommodation, and living expenses.

- What is the maximum amount that can be borrowed?

- The maximum amount that can be borrowed is determined by the cost of the studies and the affordability of the parent/legal guardian/sponsor.

- How can I apply for the FNB LifeStart Student Loan (study loan FNB)?

- You can apply for the loan online through the FNB Namibia website or by visiting your nearest FNB branch.

- What are the qualifying criteria for the FNB LifeStart Student Loan (study loan FNB)?

- To qualify for the loan, the student must be registered at a recognized institution of higher learning, and the parent/legal guardian/sponsor must have a clear credit record and afford to repay the loan.

FNB Upfront Bond and Home Loans: Your Path to Homeownership

Budget When Buying a Home: Budgeting Tips and Advice from FNB Home Loans

Document required For FNB Home Loan Application: Documents You Need to Have

FNB Namibia Building Loan: Your guide to building your dream home

FNB eWallet: A Simple and Convenient Way to Send Money in Namibia

If you have more questions, look through our blog for answers!

Leave a Reply